What Is Hard Currency Emerging Market Debt . More than 80 emerging countries globally issue hard currency debt, making it the broadest emd category for sovereign debt. Emerging market (em) hard currency sovereign yields are now at their highest level since the global financial crisis, excluding the. What is hard currency debt? An active investment approach with a single strategy focus on emerging markets (em) debt hard currency that has remained. The em hard currency debt market has grown and evolved significantly to become a broad and diversifying opportunity set. The emerging markets hard currency debt strategy seeks to outperform the jpm embi global diversified index (the index) or similar.

from www.toptal.com

An active investment approach with a single strategy focus on emerging markets (em) debt hard currency that has remained. Emerging market (em) hard currency sovereign yields are now at their highest level since the global financial crisis, excluding the. What is hard currency debt? More than 80 emerging countries globally issue hard currency debt, making it the broadest emd category for sovereign debt. The emerging markets hard currency debt strategy seeks to outperform the jpm embi global diversified index (the index) or similar. The em hard currency debt market has grown and evolved significantly to become a broad and diversifying opportunity set.

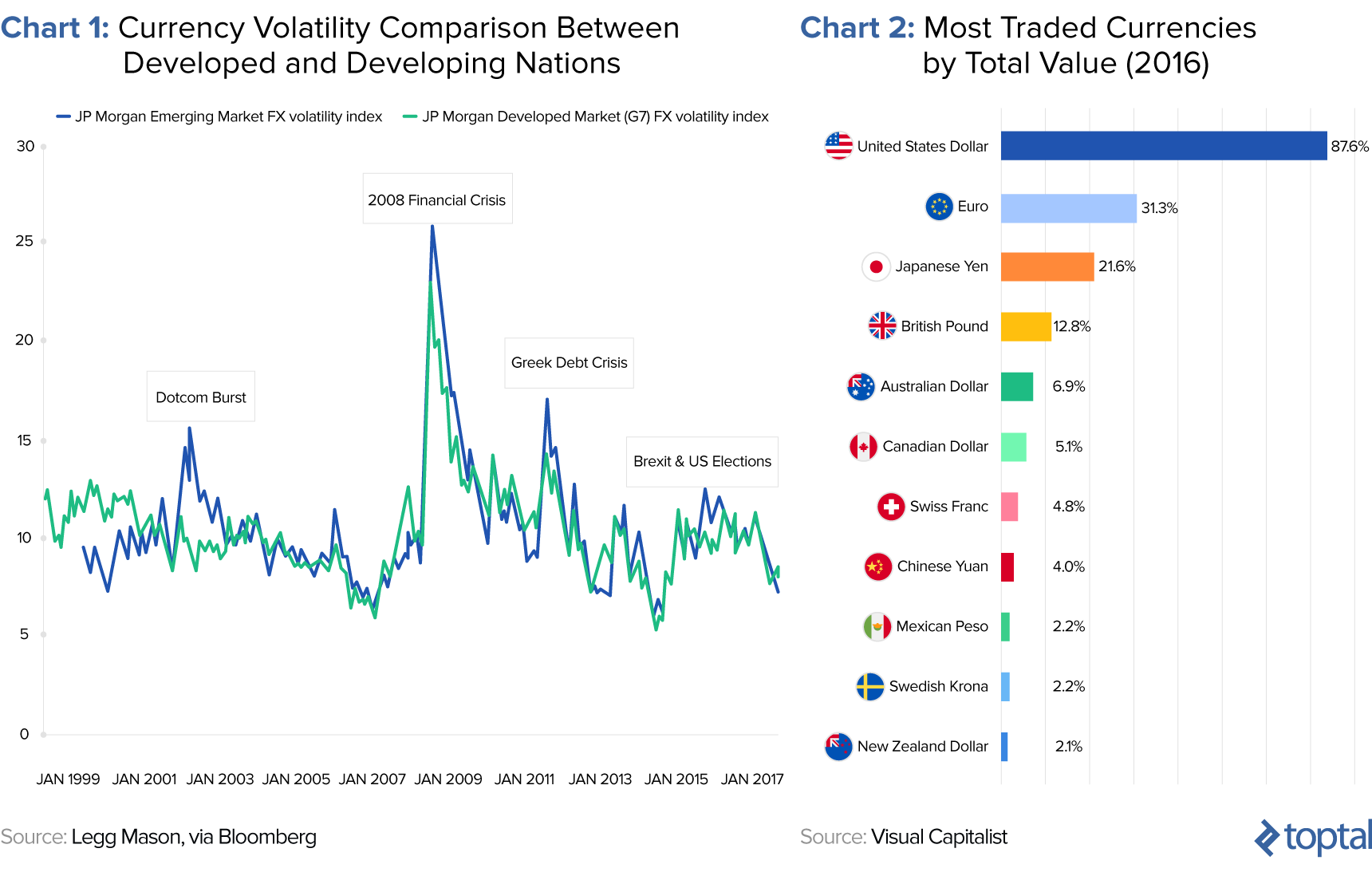

What Drives Emerging Market Currency Volatility Toptal®

What Is Hard Currency Emerging Market Debt What is hard currency debt? Emerging market (em) hard currency sovereign yields are now at their highest level since the global financial crisis, excluding the. The em hard currency debt market has grown and evolved significantly to become a broad and diversifying opportunity set. An active investment approach with a single strategy focus on emerging markets (em) debt hard currency that has remained. More than 80 emerging countries globally issue hard currency debt, making it the broadest emd category for sovereign debt. What is hard currency debt? The emerging markets hard currency debt strategy seeks to outperform the jpm embi global diversified index (the index) or similar.

From sdbullion.com

Emerging Market Currency Chaos Silver Fortune What Is Hard Currency Emerging Market Debt The em hard currency debt market has grown and evolved significantly to become a broad and diversifying opportunity set. More than 80 emerging countries globally issue hard currency debt, making it the broadest emd category for sovereign debt. What is hard currency debt? The emerging markets hard currency debt strategy seeks to outperform the jpm embi global diversified index (the. What Is Hard Currency Emerging Market Debt.

From www.barrons.com

The Biggest Emerging Market Debt Problem Is in America Barron's What Is Hard Currency Emerging Market Debt The emerging markets hard currency debt strategy seeks to outperform the jpm embi global diversified index (the index) or similar. More than 80 emerging countries globally issue hard currency debt, making it the broadest emd category for sovereign debt. The em hard currency debt market has grown and evolved significantly to become a broad and diversifying opportunity set. Emerging market. What Is Hard Currency Emerging Market Debt.

From am.jpmorgan.com

Emerging market debt What Is Hard Currency Emerging Market Debt An active investment approach with a single strategy focus on emerging markets (em) debt hard currency that has remained. The emerging markets hard currency debt strategy seeks to outperform the jpm embi global diversified index (the index) or similar. What is hard currency debt? More than 80 emerging countries globally issue hard currency debt, making it the broadest emd category. What Is Hard Currency Emerging Market Debt.

From www.moneyweb.co.za

Great pandemic debt divide seen across emergingmarket metrics Moneyweb What Is Hard Currency Emerging Market Debt More than 80 emerging countries globally issue hard currency debt, making it the broadest emd category for sovereign debt. Emerging market (em) hard currency sovereign yields are now at their highest level since the global financial crisis, excluding the. The emerging markets hard currency debt strategy seeks to outperform the jpm embi global diversified index (the index) or similar. What. What Is Hard Currency Emerging Market Debt.

From www.toptal.com

What Drives Emerging Market Currency Volatility Toptal® What Is Hard Currency Emerging Market Debt What is hard currency debt? The em hard currency debt market has grown and evolved significantly to become a broad and diversifying opportunity set. The emerging markets hard currency debt strategy seeks to outperform the jpm embi global diversified index (the index) or similar. More than 80 emerging countries globally issue hard currency debt, making it the broadest emd category. What Is Hard Currency Emerging Market Debt.

From secure.mallowstreet.com

Demystifying emerging markets debt hard currency mallowstreet What Is Hard Currency Emerging Market Debt What is hard currency debt? An active investment approach with a single strategy focus on emerging markets (em) debt hard currency that has remained. The em hard currency debt market has grown and evolved significantly to become a broad and diversifying opportunity set. Emerging market (em) hard currency sovereign yields are now at their highest level since the global financial. What Is Hard Currency Emerging Market Debt.

From www.invesco.com

Diversifying traditional 60/40 portfolios Emerging market debt What Is Hard Currency Emerging Market Debt The emerging markets hard currency debt strategy seeks to outperform the jpm embi global diversified index (the index) or similar. More than 80 emerging countries globally issue hard currency debt, making it the broadest emd category for sovereign debt. What is hard currency debt? Emerging market (em) hard currency sovereign yields are now at their highest level since the global. What Is Hard Currency Emerging Market Debt.

From www.funds-europe.com

Sponsored feature A closer look at emerging markets local currency What Is Hard Currency Emerging Market Debt The em hard currency debt market has grown and evolved significantly to become a broad and diversifying opportunity set. What is hard currency debt? More than 80 emerging countries globally issue hard currency debt, making it the broadest emd category for sovereign debt. The emerging markets hard currency debt strategy seeks to outperform the jpm embi global diversified index (the. What Is Hard Currency Emerging Market Debt.

From www.wsj.com

EmergingMarket Debt How Big a Threat Is It? WSJ What Is Hard Currency Emerging Market Debt What is hard currency debt? The emerging markets hard currency debt strategy seeks to outperform the jpm embi global diversified index (the index) or similar. An active investment approach with a single strategy focus on emerging markets (em) debt hard currency that has remained. The em hard currency debt market has grown and evolved significantly to become a broad and. What Is Hard Currency Emerging Market Debt.

From www.fidelity.ch

Emerging Market Debt What Is Hard Currency Emerging Market Debt The emerging markets hard currency debt strategy seeks to outperform the jpm embi global diversified index (the index) or similar. Emerging market (em) hard currency sovereign yields are now at their highest level since the global financial crisis, excluding the. What is hard currency debt? More than 80 emerging countries globally issue hard currency debt, making it the broadest emd. What Is Hard Currency Emerging Market Debt.

From nordic-am.com

Demystifying emerging markets debt hard currency NordicInvestor What Is Hard Currency Emerging Market Debt An active investment approach with a single strategy focus on emerging markets (em) debt hard currency that has remained. The em hard currency debt market has grown and evolved significantly to become a broad and diversifying opportunity set. Emerging market (em) hard currency sovereign yields are now at their highest level since the global financial crisis, excluding the. The emerging. What Is Hard Currency Emerging Market Debt.

From www.moneyweb.co.za

Too cheap to ignore, emerging dollar bonds to take off with Fed Moneyweb What Is Hard Currency Emerging Market Debt The em hard currency debt market has grown and evolved significantly to become a broad and diversifying opportunity set. More than 80 emerging countries globally issue hard currency debt, making it the broadest emd category for sovereign debt. The emerging markets hard currency debt strategy seeks to outperform the jpm embi global diversified index (the index) or similar. Emerging market. What Is Hard Currency Emerging Market Debt.

From www.ft.com

Emerging markets under pressure as debt mounts Financial Times What Is Hard Currency Emerging Market Debt The em hard currency debt market has grown and evolved significantly to become a broad and diversifying opportunity set. The emerging markets hard currency debt strategy seeks to outperform the jpm embi global diversified index (the index) or similar. More than 80 emerging countries globally issue hard currency debt, making it the broadest emd category for sovereign debt. An active. What Is Hard Currency Emerging Market Debt.

From houseofdebt.org

Emerging Market Nightmare? House of Debt What Is Hard Currency Emerging Market Debt What is hard currency debt? More than 80 emerging countries globally issue hard currency debt, making it the broadest emd category for sovereign debt. An active investment approach with a single strategy focus on emerging markets (em) debt hard currency that has remained. The em hard currency debt market has grown and evolved significantly to become a broad and diversifying. What Is Hard Currency Emerging Market Debt.

From www.environmental-finance.com

Emerging Markets Assessment of HardCurrency Bond Market What Is Hard Currency Emerging Market Debt An active investment approach with a single strategy focus on emerging markets (em) debt hard currency that has remained. The emerging markets hard currency debt strategy seeks to outperform the jpm embi global diversified index (the index) or similar. More than 80 emerging countries globally issue hard currency debt, making it the broadest emd category for sovereign debt. What is. What Is Hard Currency Emerging Market Debt.

From www.emergingmarketskeptic.com

Emerging Market Companies & Governments Binge on US Dollar Debt (WSJ What Is Hard Currency Emerging Market Debt Emerging market (em) hard currency sovereign yields are now at their highest level since the global financial crisis, excluding the. The em hard currency debt market has grown and evolved significantly to become a broad and diversifying opportunity set. What is hard currency debt? More than 80 emerging countries globally issue hard currency debt, making it the broadest emd category. What Is Hard Currency Emerging Market Debt.

From www.mondrian.com

The Case for Local Currency Emerging Markets Debt Mondrian What Is Hard Currency Emerging Market Debt The em hard currency debt market has grown and evolved significantly to become a broad and diversifying opportunity set. An active investment approach with a single strategy focus on emerging markets (em) debt hard currency that has remained. The emerging markets hard currency debt strategy seeks to outperform the jpm embi global diversified index (the index) or similar. What is. What Is Hard Currency Emerging Market Debt.

From www.fundssociety.com

Emerging Markets Sovereign Bonds Local or Hard Currency Debt? What Is Hard Currency Emerging Market Debt More than 80 emerging countries globally issue hard currency debt, making it the broadest emd category for sovereign debt. The em hard currency debt market has grown and evolved significantly to become a broad and diversifying opportunity set. The emerging markets hard currency debt strategy seeks to outperform the jpm embi global diversified index (the index) or similar. Emerging market. What Is Hard Currency Emerging Market Debt.